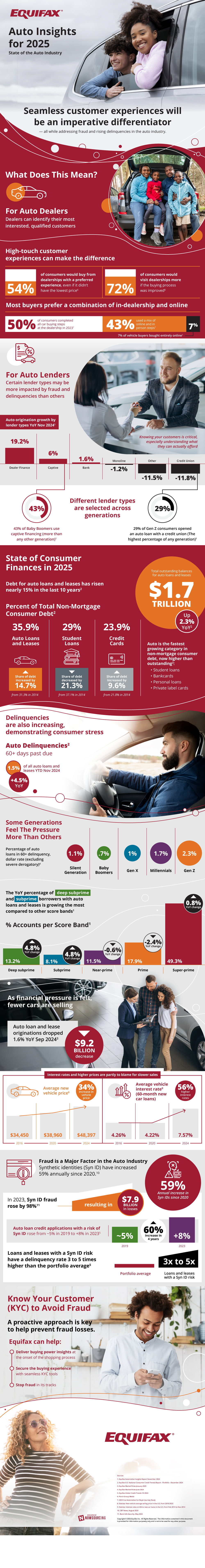

In recent years, consumer finances have become a concern for many economists. And for good reason, as the proportion of prime and near-prime loans is decreasing while subprime and deep-subprime are increasing. Since 2014, the share of credit card debt increased by 9.6% and auto financing agreements their share of debt increased by 14.7% in the same timeframe. This means that the total outstanding balances of all auto loans and leases have ballooned to $1.7 billion, and a 2.3% increase year over year. This financial pressure is not without any ramifications, though. With the high amounts of existing debt, auto industry trends show new auto loans and leases dropped by 1.6% and saw a $9.2 billion decrease.

Some individuals, however, try to get new car loans in spite of existing debt by utilizing a synthetic identity (Syn ID). Loans with a Syn ID are much riskier, as they have a much higher fraud rate and a delinquency rate between 3 to 5 times higher. Fortunately, companies like Equifax make it easy to protect against these Syn ID’s. They deliver insights into the consumers’ buying power during the shopping process, before any financing agreements occur. To make sure you know who your customers are, taking advantage of Equifax is the best move for your business.