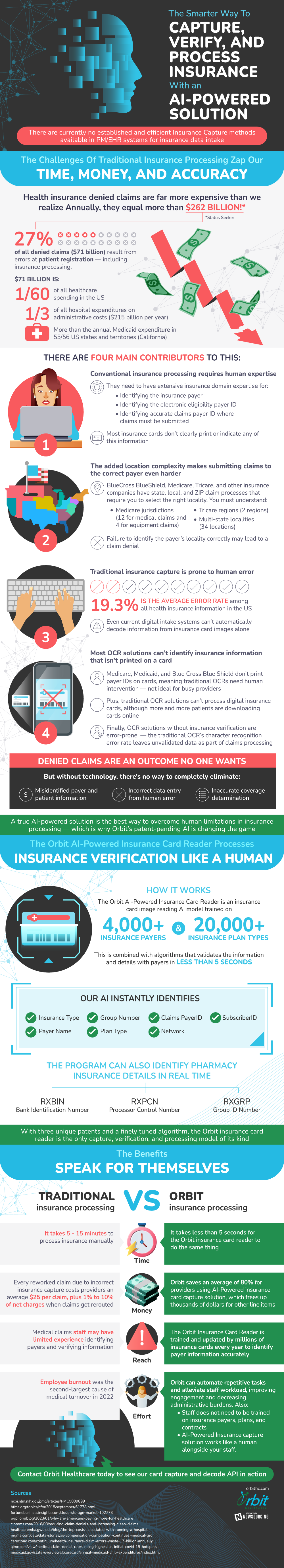

Insurance processing is lightyears behind many other industries in terms of technological advancement. Traditional methods hold many challenges including being time-consuming, costly, and lacking in accuracy. These challenges can create another huge problem in claims being denied. These denied claims cost companies billions annually as well as hurt those submitting the claims in that they lose money they thought they would be getting back. All of these issues continue to show a pressing need for change.

The main contributors to insurance processing issues lie in human intervention. Many current methods require human expertise, leading to a greater possibility of error. This also causes hindrance for those who are not as familiar with the correct way to process claims. In fact, the average error rate in health insurance is nearly 20%. Aside from human error, location issues and current information identification limitations are also abundant.

Early development for a new solution points towards using an AI-powered way to overcome human shortcomings in insurance processing. This new technology can identify more information than any current solution can and is able to do so in mere seconds. The benefits of new technology outweigh the traditional methods, paving the way for a brighter and more efficient future for the industry.